NJ RTF-1 2017-2026 free printable template

Show details

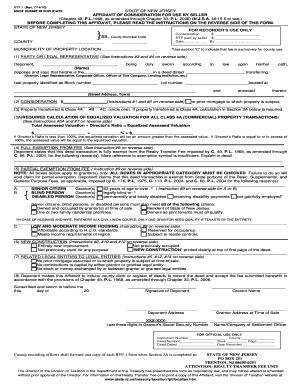

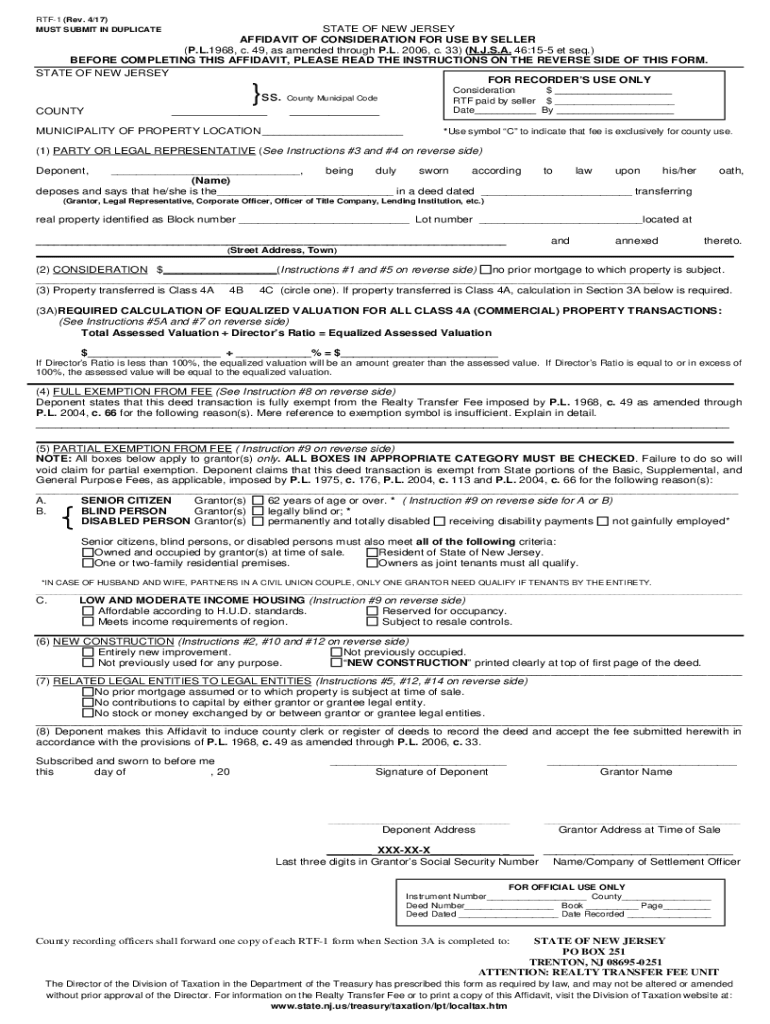

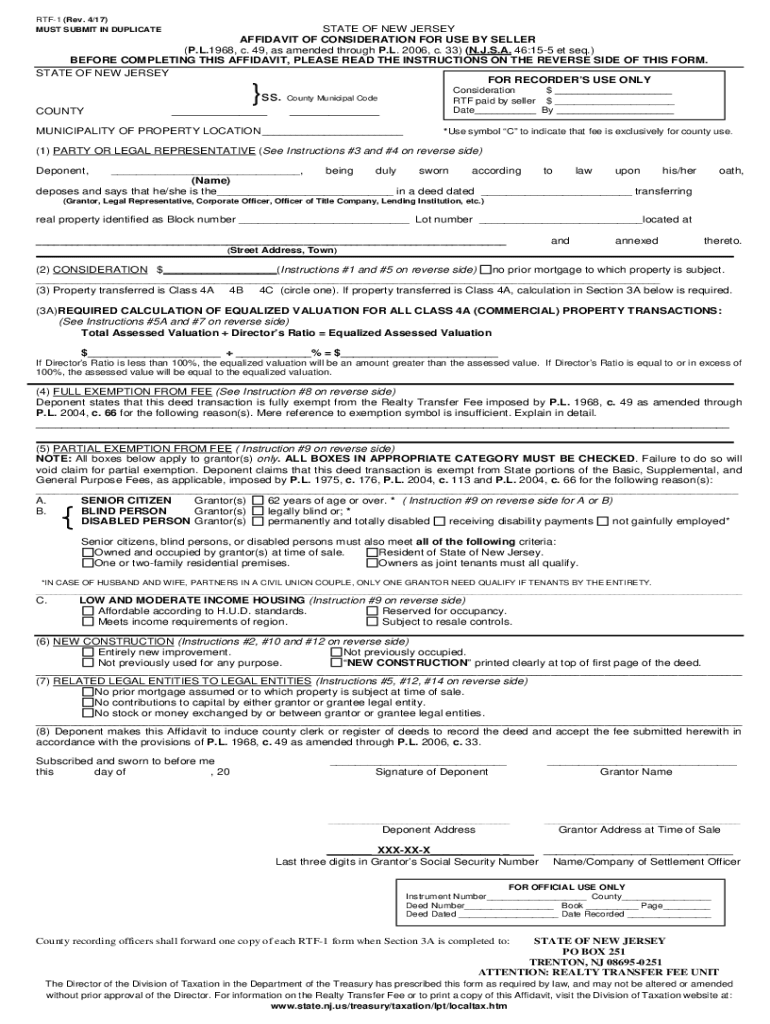

RTF-1 Rev. 7/14/10 MUST SUBMIT IN DUPLICATE STATE OF NEW JERSEY AFFIDAVIT OF CONSIDERATION FOR USE BY SELLER Chapter 49 P. For information on the Realty Transfer Fee or to print a copy of this Affidavit visit the Division of Taxation website at www. state. nj. us/treasury/taxation/lpt/localtax. htm INSTRUCTIONS FOR FILING FORM RTF-1 AFFIDAVIT OF CONSIDERATION FOR USE BY SELLER STATEMENT OF CONSIDERATION AND REALTY TRANSFER FEE PAYMENT ARE PREREQUISITES FOR DEED RECORDING No county recording...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign consideration rtf 1 form

Edit your nj consideration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit consideration seller fill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit of consideration for use by seller online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rtf 1 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ RTF-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rtf 1 form

How to fill out NJ RTF-1

01

Obtain the NJ RTF-1 form from the official New Jersey state website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details about your property, including the type of property and its location.

04

Indicate the date of the property transfer or sale.

05

Review the applicable exemptions or deductions you might qualify for and fill in the relevant sections.

06

Calculate the total amount due based on the instructions provided on the form.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form either by mailing it to the address specified or by submitting it electronically if allowed.

Who needs NJ RTF-1?

01

Individuals or entities who are transferring property ownership in New Jersey.

02

Real estate professionals facilitating property transactions.

03

Property buyers and sellers who need to report information for tax purposes.

Fill

seller affidavit of consideration nj

: Try Risk Free

People Also Ask about rtf 1 nj fillable

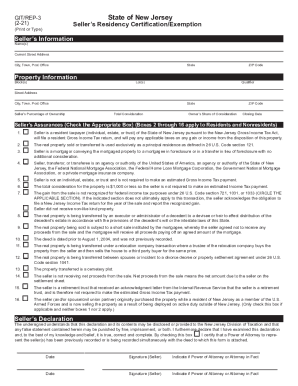

Who is exempt from transfer tax NJ?

The sale of a property between parent and child, husband and wife, and siblings are exempt. The transfer of a deed from a stepparent to a step-child is only 50% exempt unless the stepparent has adopted that child.

How do I avoid transfer tax in NJ?

Exemptions To the NJ Realty Transfer Fee Transactions Under $100. If the consideration is valued at less than $100, the NJ Realty Transfer fee will not apply. Government Agencies and Institutions. Debt Release Transfers. Exemptions for Co-ops.

How to avoid NJ mansion tax?

To avoid paying the mansion tax you must do one of the following: Buy a property for $999,999 or less, or. Get creative for prices slightly above $1 million. For example, negotiating with the seller or reaching an agreement with the seller.

Who pays the transfer tax in New Jersey?

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more. You can find more information on the Realty Transfer Fee, including rates and exemptions, here.

Who pays millionaire tax in NJ?

The mansion tax was introduced in 2004 when home values were considerably less than they are now and $1 million home prices were much less commonplace. Unless otherwise agreed upon by the buyer and seller, the mansion tax is typically paid by the buyer at closing.

Who pays real estate transfer tax in NJ?

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more. You can find more information on the Realty Transfer Fee, including rates and exemptions, here.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 10 affidavit consideration in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your nj rtf 1 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete affidavit consideration nj online?

pdfFiller makes it easy to finish and sign rtf 1 nj online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I fill out rtf 1 new jersey on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your affidavit of consideration nj by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is NJ RTF-1?

NJ RTF-1 is the New Jersey Real Estate Transfer Fee form used to report the transfer of real property in New Jersey.

Who is required to file NJ RTF-1?

The seller of the real property is required to file NJ RTF-1 when transferring ownership.

How to fill out NJ RTF-1?

To fill out NJ RTF-1, you need to provide property information, the names of the buyer and seller, the sale price, and any exemptions that may apply.

What is the purpose of NJ RTF-1?

The purpose of NJ RTF-1 is to collect information on real estate transfers for taxation and record-keeping purposes.

What information must be reported on NJ RTF-1?

The information that must be reported on NJ RTF-1 includes the names of the parties involved, the property address, sale price, and the date of transfer.

Fill out your NJ RTF-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nj Sellers Affidavit Of Consideration is not the form you're looking for?Search for another form here.

Keywords relevant to rtf 1ee affidavit of consideration

Related to rtf1 nj

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.